Will the Federal Reserve Lower the Rates Again

It begins. The Federal Reserve announced today the get-go increase in the federal funds charge per unit since December 2018, lifting the key policy rate by a quarter of a percentage point. At the same time, the Fed also noted that it "anticipates that ongoing increases in the target range will be appropriate." As such, we are likely at the first of what may be aggressive tightening cycle for budgetary policy.

This coming together also featured an updated Summary of Economic Projections, where Fed members reveal their expectations for economic growth, aggrandizement, unemployment and their forecasts for where they call up the federal funds rate will be at the end of 2022, 2023, 2024 and over a longer-term time horizon. Anyone who might have been hoping for a mild upward tendency for monetary policy is likely to be disappointed; unlike in December, when the SEP showed an expectation of perhaps 3 or 4 increases in the federal funds rate this twelvemonth, bringing it to perhaps a 0.9% level, the newest update now suggests seven or more than increases to a median level of ane.ix% over the adjacent nine months. Forecasts for more hikes in next year were also revealed, and the federal funds charge per unit is currently expected by fed members to reach a median value of 2.8% by the stop of 2023, up a total 120 footing points (1.2%) from the outlook only three months agone.

This of course was triggered by increased expectations for higher cadre PCE inflation (upwardly from a forecast ii.7% in December to four.1% at present). Influencing the ramped-up outlook for the fundamental policy rate was the collective opinion that markets will remain tight for the next couple of years, just at that place were too diminished expectations for GDP growth this year as the outlook was pulled downward from iv% to just two.8%.

The Fed'due south QE-style bail buying program came to a shut earlier this month, but the fundamental bank has not yet decided to share with investors exactly how information technology intends to offset to divest itself of its massive holdings of Treasurys and Mortgage-Backed Securities that comprise its "residuum canvas" (investment portfolio). All it offered in regards to this was a simple statement that "the Commission expects to begin reducing its holdings of Treasury securities and agency debt and bureau mortgage-backed securities at a coming meeting." In the press briefing afterwards the meeting had shut, Fed Chair Powell intimated that the Commission had made expert progress on its plans to trim holdings, and left a strong impression that the first reductions would come after the close of the adjacent coming together in early May.

If they should follow the playbook from last time, this will exist accomplished by no longer using the gain of inbound involvement and principal payments from holdings to buy more bonds. Most likely, they will look to limit then-called "runoff" through the apply of caps, so equally to have a methodical reduction over time. In such a method, the Fed may set a goal of assuasive (for instance) $50 billion per month of securities to retire each month; whatever inbound funds higher up this level would exist used to buy more bonds, and then portfolio reduction would be maintained at the desired measured pace.

The Fed has noted that it ultimately intends to return its investment holdings to be comprised solely of Treasurys. It will do so by reducing "securities holdings over time in a predictable manner primarily by adjusting the amounts reinvested of chief payments received from securities." Equally the Fed holds some $2.691 trillion in mortgage holdings -- double the corporeality information technology held pre-pandemic -- information technology may take more chief repayments to materially reduce holdings of mortgages. It would be i thing if lots of mortgages were being refinanced and holdings shrank quickly as a effect, but with mortgage rates already firming and higher rates more likely than not, refinancing likely won't provide a reliable pace of reduction.

Some mortgages will fall out as an existing homeowner sells and closes out a loan and so takes on a new mortgage elsewhere; this would run across the loan drop out of the Fed's portfolio and non be re-added as a new loan. Withal, the market for purchase mortgages is considerably smaller than that for refinancing, so this may fail to assist holdings fall very quickly, either. It may be that at some bespeak that in club to more than speedily change the limerick of its balance sheet, the Fed may look to sell some of MBS outright, something it didn't practice last time, although it never ruled out the possibility that information technology could happen. The Fed may choose to conduct outright sales of MBS this fourth dimension, but probably not until (or unless) the normal stride of runoff is as well slow for the primal depository financial institution's liking and in that location is unmet demand in the market for such instruments.

The Fed'due south "dual mandate" sees it perpetually seeking stable prices in the context of full employment. The Fed considers a broad range of labor-market indicators, from measures of unemployment, wage and benefit cost changes, labor forcefulness participation and others. The pandemic has created considerable upheaval in the labor force, with millions of workers notwithstanding not engaged in the workforce despite record levels of job openings and ascension wages. Retirements, COVID concerns, child- and family-care issues and a range of increased government supports are probably all playing a function here, making it a challenge for the Fed to know what "total employment" might really be, but near indicators suggest we are fairly close.

That there are literally millions more jobs available than workers who are interested in filling them gives the Fed rather a bit of leeway to elevator interest rates and look to absurd need without grave concerns that unemployment will kick college apace. More than probable, equally financial conditions tighten, these "backlog" job openings will first disappear as amass demand is tempered, bringing into better balance the supply of and need for labor.

From the statement: "The Committee seeks to attain maximum employment and inflation at the charge per unit of ii percent over the longer run. With advisable firming in the stance of monetary policy, the Commission expects inflation to return to its 2 percent objective and the labor market to remain strong. In support of these goals, the Committee decided to enhance the target range for the federal funds charge per unit to 1/4 to 1/2 per centum and anticipates that ongoing increases in the target range will be appropriate."

With the COVID-19 situation profoundly improved here in the U.Due south. (although not so much elsewhere) the statement didn't include a argument of concern about the pandemic this fourth dimension, only 1 that expressed concern about the situation in Ukraine and the uncertainty is has injected into the outlook: "The invasion of Ukraine by Russia is causing tremendous human being and economic hardship. The implications for the U.S. economy are highly uncertain, but in the near term the invasion and related events are likely to create additional upward pressure on inflation and weigh on economic activity."

The side by side scheduled FOMC meeting will occur on May iii-4, 2022. The coming coming together will non offering an updated Summary of Economical Projections, merely volition likely reveal plans for rest-canvass reduction.

What is the federal funds charge per unit?

The federal funds rate is an intrabank, overnight lending rate. The Federal Reserve increases or decreases this then-called "target rate" when it wants to cool or spur economic growth.

The last Fed move on March sixteen, 2022 was the start increase in the funds charge per unit since 2018, when the Fed completed a cycle of increasing interest rates.

By the Fed 's recent thinking, the long-run "neutral" charge per unit for the federal funds may be as low equally 2.5 percent, a level well below what has long been considered to be "normal" levels. Equally such, even if rates do rising over time, and perhaps even quickly, they may not get shut to celebrated "normal" for a while yet.

The Fed tin can either establish a range for the federal funds rate, or may express a single value.

Related content: Federal Funds Rate - Graph and Table of Values

How does the Federal Reserve affect mortgage rates?

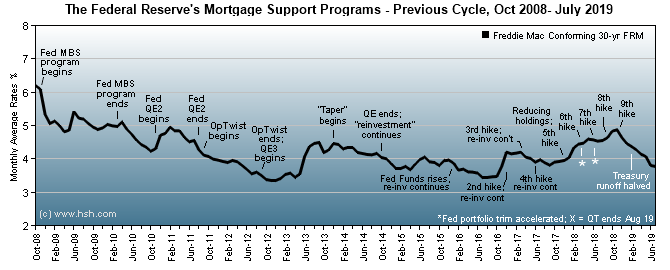

Historically, the Federal Reserve has only had an indirect impact on well-nigh mortgage rates, especially fixed-rate mortgages. That changed back in 2008, when the central bank began directly ownership Mortgage-Backed Securities (MBS) and financing bonds offered by Fannie Mae and Freddie Mac. This "liquefied" mortgage markets, giving investors a ready place to sell their holdings as needed, helping to drive down mortgage rates.

After the programme of MBS and debt aggregating by the Fed ended, they were notwithstanding "recycling" inbound proceeds from maturing and refinanced mortgages to purchase replacement bonds for a number of years. This kept their holdings level and provided a steady presence in the mortgage market, which helped to proceed mortgage rates steady.

In June 2017, the Fed announced that the process of reducing its so-chosen "balance sheet" (holdings of Treasuries and MBS) would showtime in Oct 2017. In this gradual procedure, the Fed trimmed dorsum the amount of reinvestment it was making in steps until information technology eventually was actively retiring sizable pieces of its holdings. When the plan was appear, the Fed held nearly $ii.46 trillion in Treasuries and about $ane.78 trillion in mortgage-related debt. It had been reducing holdings at a ready amount and was on a long-run pace of "autopilot" reductions as recently every bit December 2018.

In 2019, the Fed decided to brainstorm winding down its residual-sheet-reduction plan with a termination date of October, only as of August 2019 decided to end reducing its holdings altogether, catastrophe the program two months early. Every bit the full amount of balance sail runoff was adequately small, and the Fed was left with a huge set of investment holdings, presently comprised of about $2.08 trillion in Treasuries and about $1.52 trillion in mortgage-related debt. Starting in August 2019, all entering proceeds from maturing investments were beingness used to buy more Treasury securities of various maturities to roughly mimic the overall balance of holdings by investors.

Too, upwards to $twenty billion each month of gain from maturing mortgage holdings (more often than not from early prepayments due to refinancing) were too to be invested in Treasuries; any redemption over that corporeality was be used to purchase more agency-backed MBS. Ultimately, the Fed looked to have a balance sheet comprised solely of Treasuries, simply irresolute the mix of holdings from mortgages to Treasuries as mortgages are repaid was expected to have many years.

In response to turbulent market weather from the coronavirus pandemic, the Fed re-started QE-style purchases of Mortgage-Backed Securities in March 2020, so non just did the slow process of converting MBS holdings to Treasuries come to a halt, the Fed has over again been actively buying up new MBS, expanding their mortgage holdings for at to the lowest degree a fourth dimension. Through October 2021, the current rate of outright purchases was $40 billion per month, and inbound gain from principal repayments on holdings and refinancings are as well being reinvested. MBS bond buys will be trimmed to $30 billion per month starting in December 2021 and to $20 billion per month in January; a like step of reduction going forward is expected. Since the Fed restarted their MBS purchasing program once more in March 2020, it had by mid-January 2021 added more $i.32 trillion of them to its residue canvass, with total holdings of MBS now topping $2.68 trillion dollars. The Fed'southward MBS holding have doubled since March 2020.

The Fed has at present concluded its latest bond-buying program. The starting time of a "runoff" program to reduce holdings will likely be announced at the shut of the May meeting and commence later that month or maybe begin in June.

What is the effect of the Fed'southward actions on mortgage rates?

Mortgage interest rates began cycling higher well in accelerate of the first increase in curt-term interest rates. This is non uncommon; inflation running higher than desired in plow lifted expectations that the Fed would lift short-term rates, which in plow has lifted the longer-term rates that influence fixed-rate mortgages.

Too of import for this new bike, is that the Fed is no longer directly supporting the mortgage market past purchasing Mortgage-Backed Securities (which helps to keep that market liquid). This means that a reliable heir-apparent of these instruments -- and one that did not care about the level of return on its investment -- has left the market. This leaves only private investors who care very much almost making profits on their holdings, and a range of risks to the economic climate may make them more wary of purchasing MBS, peculiarly at relatively low yields. At the same time, the Fed is no longer purchasing Treasury bonds to assistance keep longer-term interest rates low, and so the influential yields on these instruments have risen somewhat as a issue.

What the Fed has to say nigh the future - how speedily or slowly information technology intends to raise rates or lower rates in 2022 and beyond - will also determine if mortgage rates volition ascension, and by how much. At the moment, and given the Fed's new long-term policy framework, the path for hereafter changes in the federal funds rate is of form uncertain, simply the current expectation is that the increase in the federal funds rate will be joined past many others in the coming cycle.

Does a change in the federal funds influence other loan rates?

Although information technology is an important indicator, the federal funds charge per unit is an interest charge per unit for a very short-term (overnight) loan. This rate does have some influence over a bank's and so-called toll of funds, and changes in this cost of funds can interpret into higher (or lower) interest rates on both deposits and loans. The effect is almost clearly seen in the prices of shorter-term loans, including automobile, personal loans and even the initial interest rate on some Adaptable Rate Mortgages (Artillery).

All the same, a change in the overnight rate generally has piffling to practice with long-term mortgage rates (30-twelvemonth, fifteen-year, etc.), which are influenced by other factors. These notably include economical growth and inflation, just also include the whims of investors, too. For more than on how mortgage rates are set by the market, see "What moves mortgage rates? (The Basics)."

Does the federal funds rate affect mortgage rates?

Whenever the Fed makes a modify to policy, we are asked the question "Does the federal funds rate affect mortgage rates?"

Just to exist clear, the curt answer is "no," as you can see in the linked nautical chart.

That said, the federal funds charge per unit is raised or lowered past the Fed in response to changing economic conditions, and long-term stock-still mortgage rates practise of course respond to those weather, and oft well in accelerate of any change in the funds charge per unit. For example, even though the Fed was still holding the funds rate steady in autumn 2016, fixed mortgage rates rose by better than three quarters of a percentage point amongst growing economic strength and a change in investor sentiment well-nigh future growth and tax policies during the period.

What does the federal funds rate straight affect?

When the funds rate does movement, it does straight bear on sure other financial products. The prime rate tends to move in lock step with the federal funds charge per unit and so affects the rates on sure products like Home Equity Lines of Credit (HELOCs), residential construction loans, some credit cards and things like business loans. All volition by and large come across fairly firsthand changes in their offered interest rates, usually of the aforementioned size as the change in the prime charge per unit or pretty close to it. For consumers or businesses with outstanding lines of credit or credit cards, the change by and large will occur over one to three billing cycles.

Related content: Fed Funds vs. Prime Rate and Mortgage Rates

After a change to fed funds, how soon volition other interest rates ascent or fall?

Changes to the fed funds charge per unit tin can take a long fourth dimension to piece of work their way fully throughout the economy, with the furnishings of a change not completely realized for half-dozen months or even longer.

Often more important than any single alter to the funds rate is how the Federal Reserve characterizes its expectations for the economy and future Fed policy. If the Fed says (or if the market place believes) that the Fed will exist aggressively lifting rates in the near future, market place involvement rates volition rise more quickly; conversely, if they indicate that a long, flat trajectory for rates is in the offing, mortgage and other loan rates will but rise gradually, if at all. For updates and details about the economic system and changes to mortgage rates, read or subscribe to HSH'south MarketTrends newsletter.

Tin can a higher federal funds rate actually cause lower mortgage rates?

Yep. At some point in the cycle, the Federal Reserve will have lifted interest rates to a point where inflation and the economy will be expected to absurd. We saw this every bit recently every bit 2018; after the 9th increase in the federal funds rate over a piffling more than than a two-twelvemonth catamenia, economic growth began to stall, inflation pressures waned, and mortgage rates retreated past more than a full percentage point.

As the marketplace starts to anticipate this economic slowing, long-term interest rates may really first to fall fifty-fifty though the Fed may still be raising short-term rates or property them steady. Long-term rates fall in anticipation of the beginnings of a cycle of reductions in the fed funds rate, and the bicycle comes full circle. For more than information on this, Fed policy and how it affects mortgage rates, see our analysis of Federal Reserve Policy and Mortgage Charge per unit Cycles

Print folio

Source: https://www.hsh.com/finance/mortgage/latest-move-by-the-federal-reserve.html

0 Response to "Will the Federal Reserve Lower the Rates Again"

Post a Comment